VI

INTERNAL REVENUE CODE OF 1954

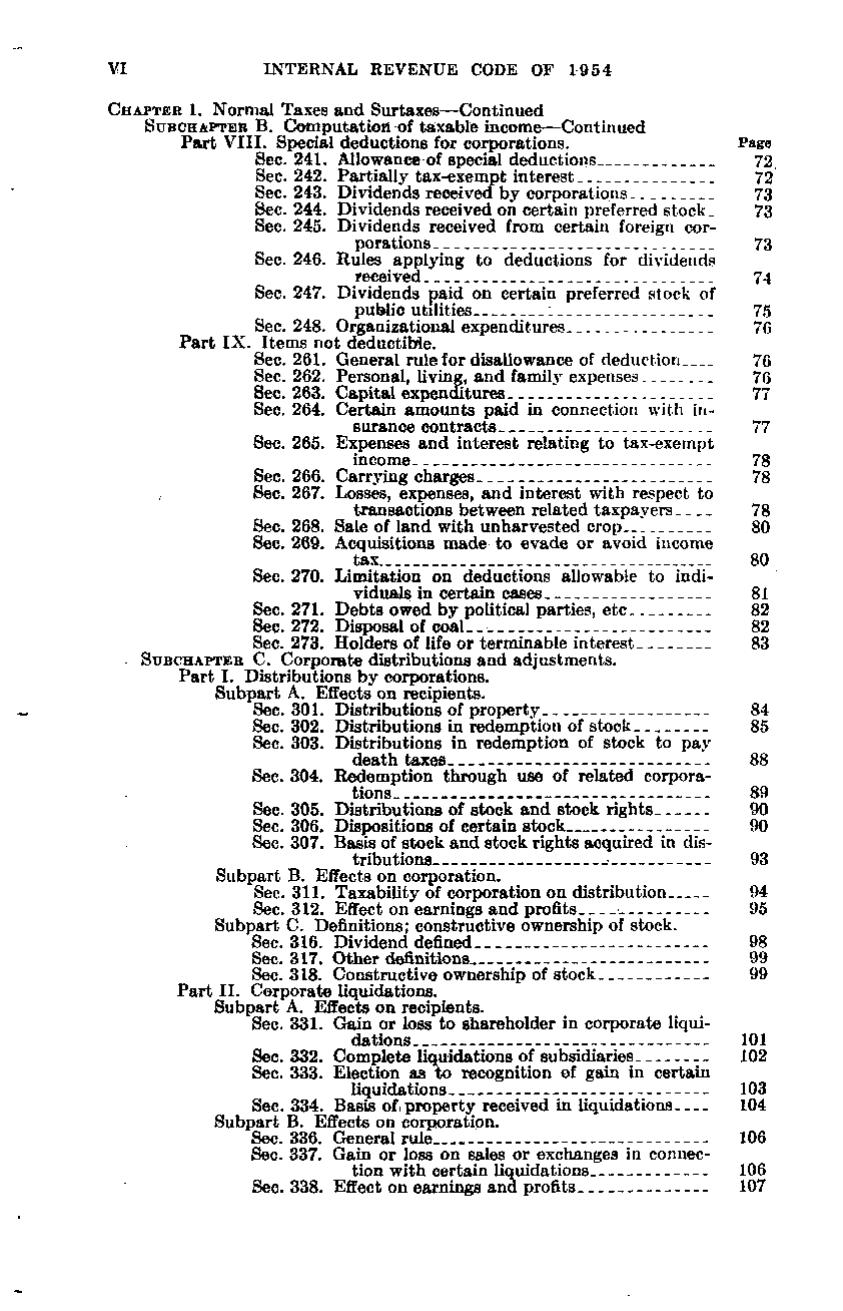

CHAPTER 1. Normal Taxes and Surtaxes—Continued SUBCHAPTER B. Computation of taxable income—Continued Part VIII. Special deductions for corporations. Sec. 241. Allowance of special deductions ^__ Sec. 242. Partially tax-exempt interest Sec. 243. Dividends received by corporations Sec. 244. Dividends received on certain preferred stock, Sec. 245. Dividends received from certain foreign corporations Sec, 246. Rules applying to deductions for dividends received Sec. 247. Dividends paid on certain preferred stock of public utilities '..Sec. 248. Organizational expenditures Part IX. Items not deductible. Sec. 261. General rule for disallowance of deduction Sec. 262. Personal, living, and family expenses Sec. 263. Capital expenditures Sec. 264. Certain amounts paid in connection with insurance contracts Sec. 265. Expenses and interest relating to tax-exempt income Sec. 266. Carrying charges ^ , Sec. 267. Losses, expenses, and interest with respect to transactions between related taxpayers Sec. 268. Sale of land with unharvested crop Sec. 269. Acquisitions made to evade or avoid income tax Sec. 270. Limitation on deductions allowable to individuals in certain cases. _ Sec. 271. Debts owed by political parties, etc Sec. 272. Disposal of coal-. ___. Sec. 273. Holders of life or terminable interest SUBCHAPTER C. Corporate distributions and adjustments. Part I. Distributions by corporations. Subpart A. Effects on recipients. Sec. 301. Distributions of property . Sec. 302. Distributions in redemption of stock Sec. 303. Distributions in redemption of stock to pay death taxes . Sec. 304. Redemption through use of related corporations__ Sec. 305. Distributions of stock and stock rights ._. Sec. 306. Dispositions of certain stock Sec. 307. Basis of stock and stock rights acquired in distributions . .— Subpart B. Effects on corporation. Sec. 311. Taxability of corporation on distribution Sec. 312. Effect on earnings and profits • Subpart C. Definitions; constructive ownership of stock. Sec. 316. Dividend defined Sec. 317. Other definitions Sec. 318. Constructive ownership of stock_. — Part II. Corporate liquidations. Subpart A. Effects on recipients. Sec. 331. Gain or loss to shareholder in corporate liquidations Sec. 332. Complete liquidations of subsidiaries Sec. 333. Election as to recognition of gain in certain liquidations Sec. 334. Basis of property received in liquidations Subpart B. Effects on corporation. Sec. 336. General rule . Sec. 337. Gain or loss on sales or exchanges in connection with certain liquidations Sec. 338. Effect on earnings and profits.

Page 72 72 73 73 73 74 75 76 76 76 77 77 78 78 78 80 80 81 82 82 83

84 85 88 89 90 90 93 94 95 98 99 99

101 102 103 104 106 106 107

�