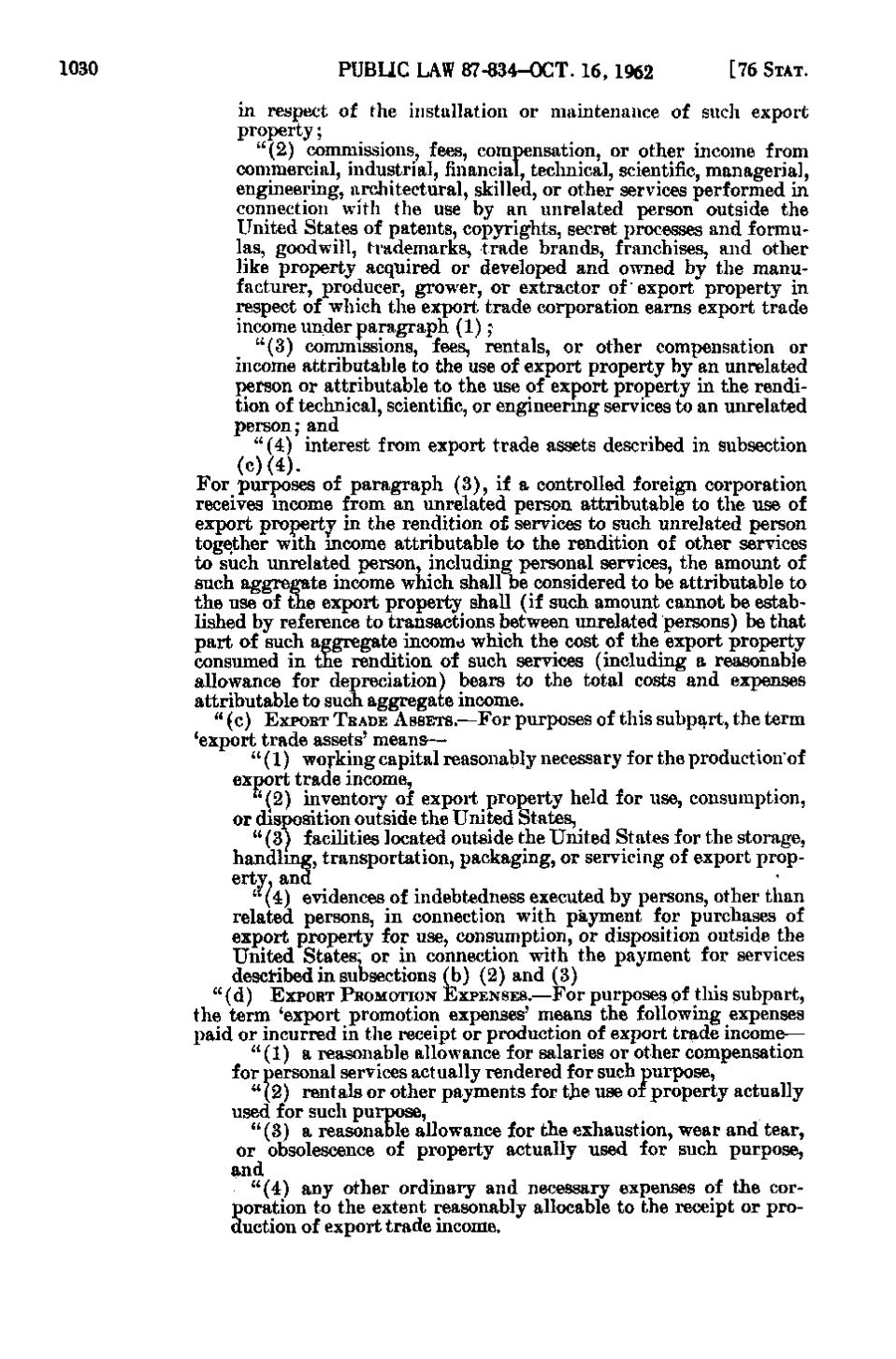

1030

PUBLIC LAW 87-834-OCT. 16, 1962

[76 STAT.

in respect of the installation or maintenance of such export property; "(2) commissions, fees, compensation, or other income from commercial, industrial, financial, technical, scientific, managerial, engineering, arcliitectural, skilled, or other services performed in connection with the use by an unrelated person outside the United States of patents, copyrights, secret processes and formulas, goodwill, trademarks, trade brands, franchises, and other like property acquired or developed and owned by the manufacturer, producer, grower, or extractor of export property in respect of which the export trade corporation earns export trade income under paragraph (1); "(3) commissions, fees, rentals, or other compensation or income attributable to the use of export property by an unrelated person or attributable to the use of export property in the rendition of technical, scientific, or engineering services to an unrelated person; and "(4) interest from export trade assets described in subsection For purposes of paragraph (3), if a controlled foreign corporation receives income from an unrelated person attributable to the use of export property in the rendition of services to such unrelated person together with mcome attributable to the rendition of other services to such unrelated person, including personal services, the amount of such aggregate income which shall be considered to be attributable to the use of the export property shall (if such amount cannot be established by reference to transactions between unrelated persons) be that part of such aggregate income which the cost of the export property consumed in the rendition of such services (including a reasonable allowance for depreciation) bears to the total costs and expenses attributable to such aggregate income. " (c) EXPORT TRADE ASSETS.—For purposes of this subpart, the term 'export trade assets' means— " (1) wo]:"king capital reasonably necessary for the production*of export trade income, "(2) inventory of export property held for use, consumption, or disposition outside the United States, " (3) facilities located outside the United States for the storage, handling, transportation, packaging, or servicing of export property, and "(4) evidences of indebtedness executed by persons, other than related persons, in connection with payment for purchases of export property for use, consumption, or disposition outside the United States, or in connection with the payment for services described in subsections (b)(2) and (3) " (d) EXPORT PROMOTION EXPENSES.—For purposes of this subpart, the term 'export promotion expenses' means the following expenses paid or incurred in the receipt or production of export trade income— "(1) a reasonable allowance for salaries or other compensation for personal services actually rendered for such purpose, " (2) rentals or other payments for the use of property actually used for such purpose, "(3) a reasonable allowance for the exhaustion, wear and tear, or obsolescence of property actually used for such purpose, and "(4) any other ordinary and necessary expenses of the corporation to the extent reasonably allocable to the receipt or production of export trade income. ..

�