1052

Ante, p. 1045.

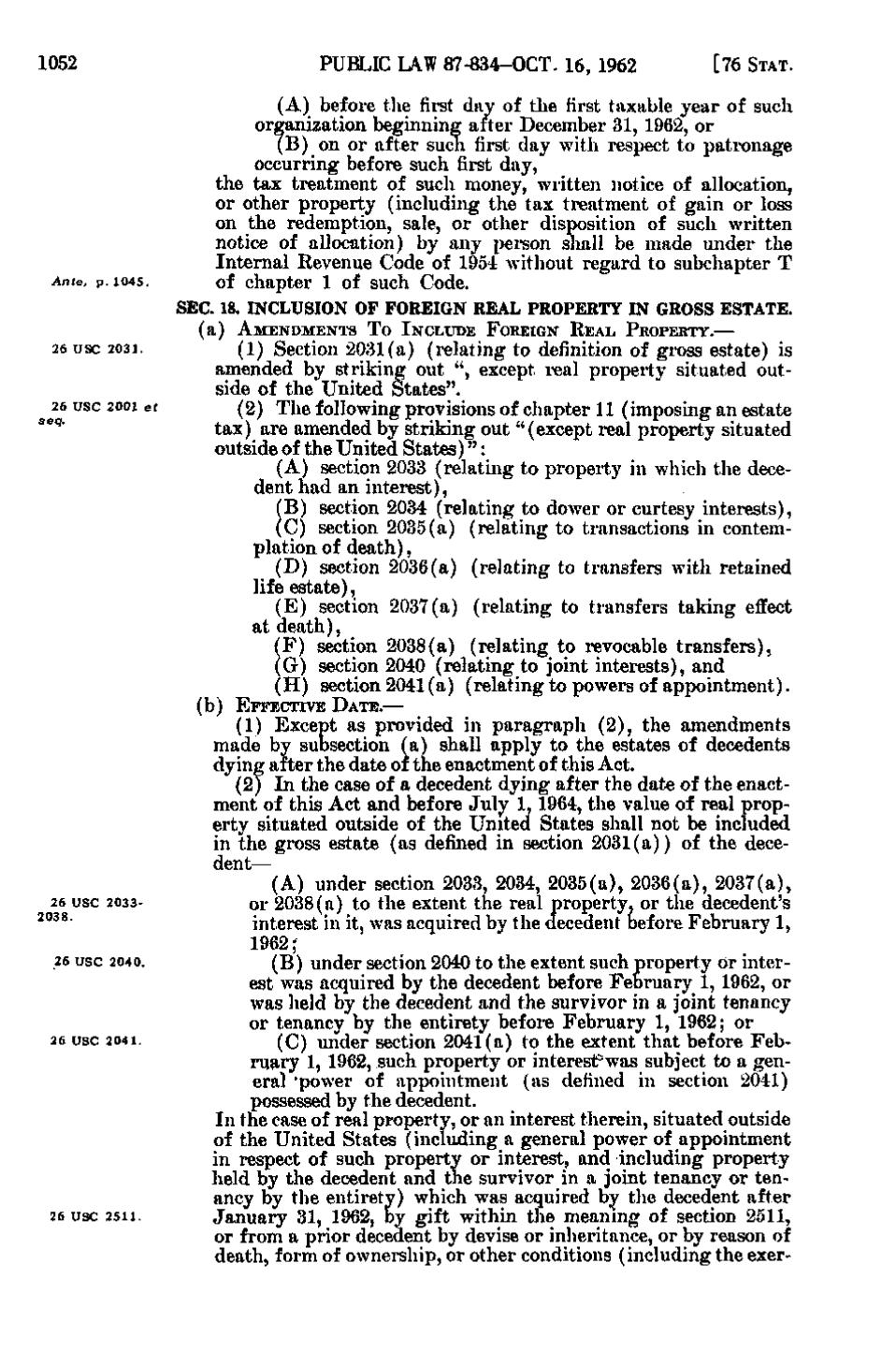

PUBLIC lAW 87-834-OCT. 16, 1962

(A) before the first day of the first taxable year of such organization beginning after December 31, 1962, or (B) on or after such first day with respect to patronage occurring before such first day, the tax treatment of such money, written notice of allocation, or other property (including the tax treatment of gain or loss on the redemption, sale, or other disposition of such written notice of allocation) by any person shall be made under the Internal Revenue Code of 1954 without regard to subchapter T of Chapter 1 of such Code. SEC. 18. INCLUSION OF FOREIGN REAL PROPERTY IN GROSS ESTATE. (a)

26 USC 2031. 26 USC 2001 et ^ seq.

2038.

26 USC 2040.

26 USC 2041.

26 USC 2511.

AMENDMENTS TO INCLUDE FOREIGN REAL PROPERTY.—

(1) Section 2031(a) (relating to definition of gross estate) is amended by striking out ", except real property situated outside of the United States". (2) The following provisions of chapter 11 (imposing an estate tax) are amended by striking out "(except real property situated outside of the United States)": (A) section 2033 (relating to property in which the decedent had an interest), (B) section 2034 (relating to dower or curtesy interests), (C) section 2035(a) (relating to transactions in contemplation of death), (D) section 2036(a) (relating to transfers with retained life estate), (E) section 2037(a) (relating to transfers taking effect at death), (F) section 2038(a) (relating to revocable transfers), (G) section 2040 (relating to joint interests), and (H) section 2041(a) (relating to powers of appointment). (b)

26 USC 2033-

[76 STAT.

EFFECTIVE DATE.—

(1) Except as provided in paragraph (2), the amendments made by subsection (a) shall apply to the estates of decedents dying after the date of the enactment of this Act. (2) I n the case of a decedent dying after the date of the enactment of this Act and before July 1, 1964, the value of real property situated outside of the United States shall not be included in the gross estate (as defined in section 2031(a)) of the decedent— (A) under section 2033, 2034, 2035(a), 2036(a), 2037(a), or 2038(a) to the extent the real property, or the decedent's interest in it, was acquired by the decedent before February 1, 1962; (B) under section 2040 to the extent such property or interest was acquired by the decedent before February 1, 1962, or was held by the decedent and the survivor in a joint tenancy or tenancy by the entirety before February 1, 1962; or (C) under section 2041(a) to the extent that before February 1, 1962, such property or interestw a s subject to a general 'power of appointment (as defined in section 2041) possessed by the decedent. In the case of real property, or an interest therein, situated outside of the United States (including a general power of appointment in respect of such property or interest, and including property held by the decedent and the survivor in a joint tenancy or tenancy by the entirety) which was acquired by the decedent after January 31, 1962, by gift within the meaning of section 2511, or from a prior decedent by devise or inheritance, or by reason of death, form of ownership, or other conditions (including the exer-

�