79 STAT. ]

PUBLIC LAW 89-97-JULY 30, 1965

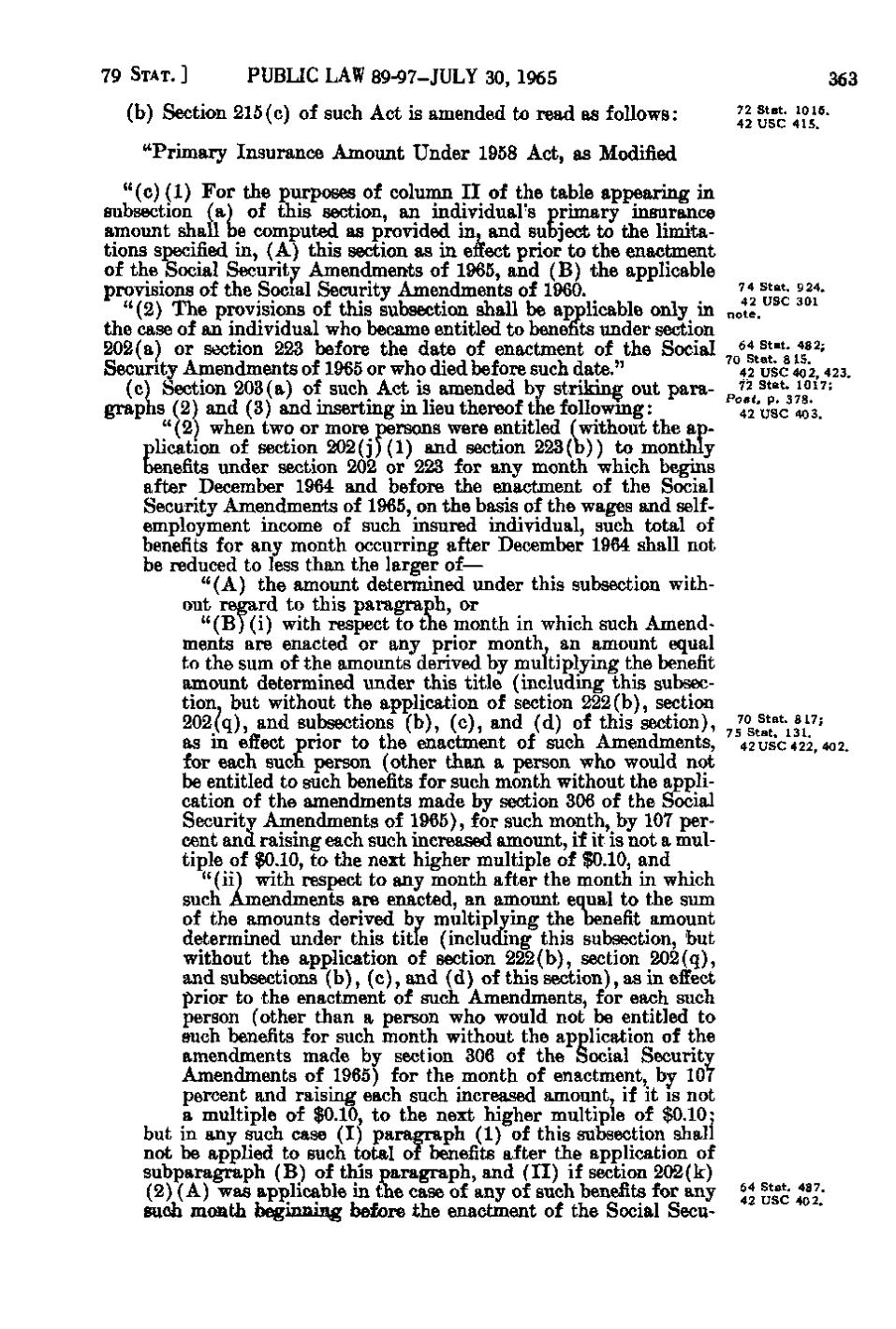

(b) Section 215(c) of such Act is amended to read as follows:

363 ^ ^^^ ^f^^^^

"Primary Insurance Amount Under 1958 Act, as Modified "(c)(1) For the purposes of column II of the table appearing in subsection (a) of this section, an individual's primary insurance amount shall be computed as provided in, and subject to the limitations specified in, (A) this section as in effect prior to the enactment of the Social Security Amendments of 1965, and (B) the applicable provisions of the Social Security Amendments of 1960. "(2) The provisions of this subsection shall be applicable only in the case of an individual who became entitled to benefits under section 202(a) or section 223 before the date of enactment of the Social Security Amendments of 1965 or who died before such date." (c) Section 203(a) of such Act is amended by striking out paragraphs (2) and (3) and inserting in lieu thereof the following: "(2) when two or more persons were entitled (without the application of section 2 0 2 (j)(l) and section 223(b)) to monthly benefits under section 202 or 223 for any month which begins after December 1964 and before the enactment of the Social Security Amendments of 1965, on the basis of the wages and selfemployment income of such insured individual, such total of benefits for any month occurring after December 1964 shall not be reduced to less than the larger of— " (A) the amount determined under this subsection without regard to this paragraph, or " (B)(i) with respect to the month in which such Amendments are enacted or any prior month, an amount equal to the sum of the amounts derived by multiplying the benefit amount determined under this title (including this subsection, but without the application of section 222(b), section 202(q), and subsections (b), (c), and (d) of this section), as in effect prior to the enactment of such Amendments, for each such person (other than a person who would not be entitled to such benefits for such month without the application of the amendments made by section 306 of the Social Security Amendments of 1965), for such month, by 107 percent and raising each such increased amount, if it is not a multiple of $0.10, to the next higher multiple of $0,10, and "(ii) with respect to any month after the month in which such Amendments are enacted, an amount equal to the sum of the amounts derived by multiplying the benefit amount determined under this title (including this subsection, but without the application of section 222(b), section 202(q), and subsections (b), (c), and (d) of this section), as in effect prior to the enactment of such Amendments, for each such person (other than a person who would not be entitled to such benefits for such month without the application of the amendments made by section 306 of the Social Security Amendments of 1965) for the month of enactment, by 107 percent and raising each such increased amount, if it is not a multiple of $0.10, to the next higher multiple of $0.10; but in any such case (I) paragraph (1) of this subsection shall not be applied to such total of benefits after the application of subparagraph (B) of this paragraph, and ( II) if section 202(k) (2)(A) was applicable in the case of any of such benefits for any such month b%inning before the enactment of the Social Secu-

'^'* s*^*- 5'24. note. ^Q^staS^si?^' 42 USC 402,423. pj|^^*^*' ^°^'^' °4Vusc 403.

^H^^^^^l^'^' 42 USC 422,402.

^^ ^^^ ^^^j-

�