88 STAT. ]

PUBLIC LAW 93-406-SEPT. 2, 1974

919

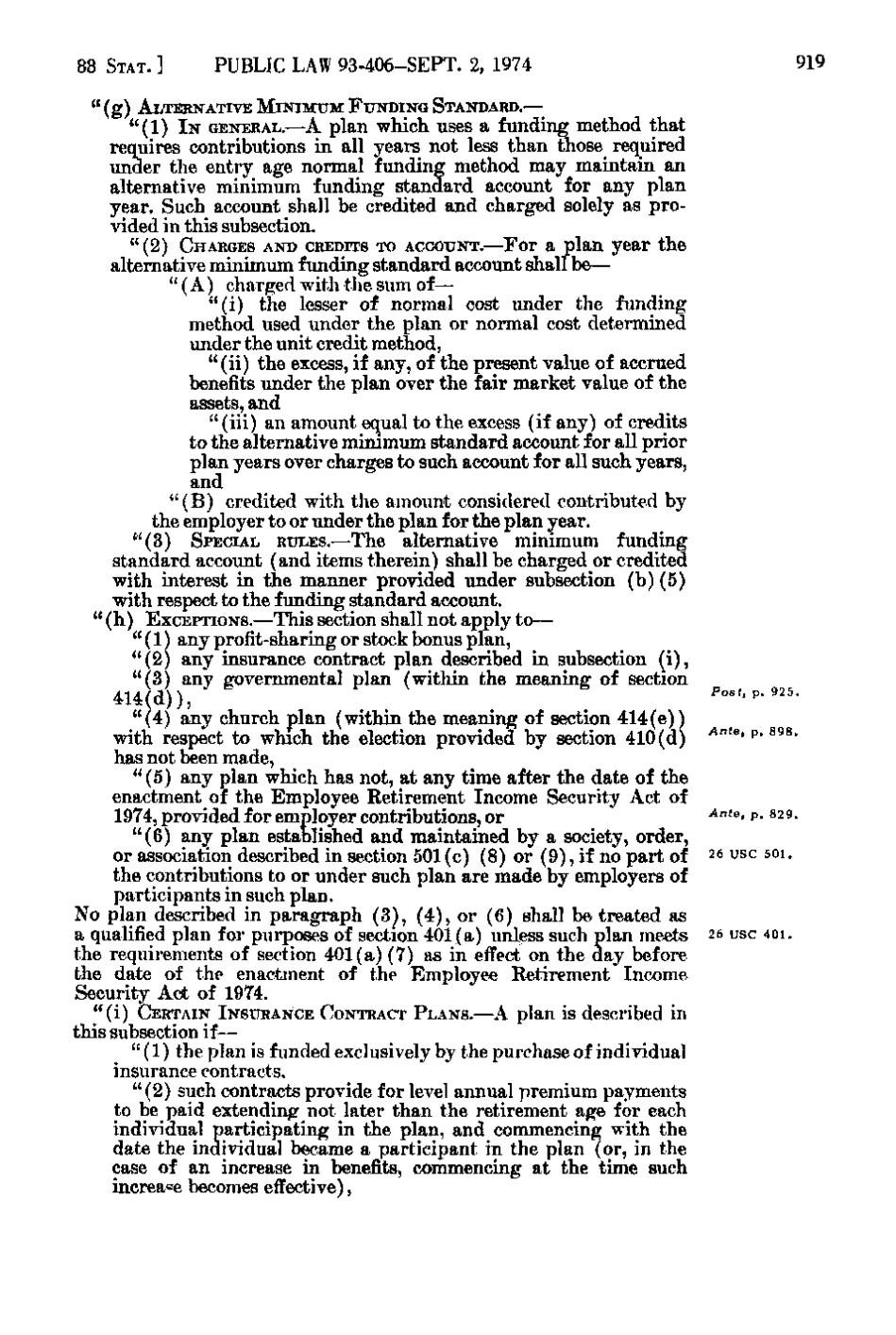

" (g) ALTERNATIVE MINIMUM FUNDING STANDARD.—

"(1) IN GENERAL.—A plan which uses a funding method that requires contributions in all years not less than those required under the entry age normal funding method may maintain an alternative minimum funding standard account for any plan year. Such account shall be credited and charged solely as provided in this subsection. "(2) CHARGES AND CREDITS TO ACCOUNT.—For a plan year the alternative minimum funding standard account shall be— " (A) charged with the sum of— "(i) the lesser of normal cost under the funding method used under the plan or normal cost determined under the unit credit method, "(ii) the excess, if any, of the present value of accrued benefits under the plan over the fair market value of the assets, and " (iii) an amount equal to the excess (if any) of credits to the alternative minimum standard account for all prior plan years over charges to such account for all such years, and " (B) credited with the amount considered contributed by the employer to or under the plan for the plan year. "(3) SPECIAL RULES.—The alternative minimum funding standard account (and items therein) shall be charged or credited with interest in the manner provided under subsection (b)(5) with respect to the funding standard account. " (h) EXCEPTIONS.—This section shall not apply to— " (1 ^ any profit-sharing or stock bonus plan, "(2) any insurance contract plan described in subsection (i), "(3) any governmental plan (within the meaning of section 414(d)), "(4) any church plan (within the meaning of section 414(e)) with respect to which the election provided by section 410(d) has not been made, "(5) any plan which has not, at any time after the date of the enactment of the Employee Retirement Income Security Act of 1974, provided for employer contributions, or "(6) any plan established and maintained by a society, order, or association described in section 501(c)(8) or (9), if no part of the contributions to or under such plan are made by employers of participants in such plan. No plan described in paragraph (3), (4), or (6) shall be treated as a qualified plan for purposes of section 401(a) unless such plan meets the requirements of section 401(a)(7) as in effect on the day before the date of the enactment of the Employee Retirement Income Security Act of 1974. " (i) CERTAIN INSURANCE CONTRACT PLANS.—A plan is described in this subsection if— " (1) the plan is funded exclusively by the purchase of individual insurance contracts, "(2) such contracts provide for level annual premium payments to be paid extending not later than the retirement age for each individual participating in the plan, and commencing with the date the individual became a participant in the plan (or, in the case of an increase in benefits, commencing at the time such increase becomes effective),

P o s t, p. 92 5.

^"'e, p. 898.

^"'^' P- ^29. 26 USC soi.

26 USC 40i.

�