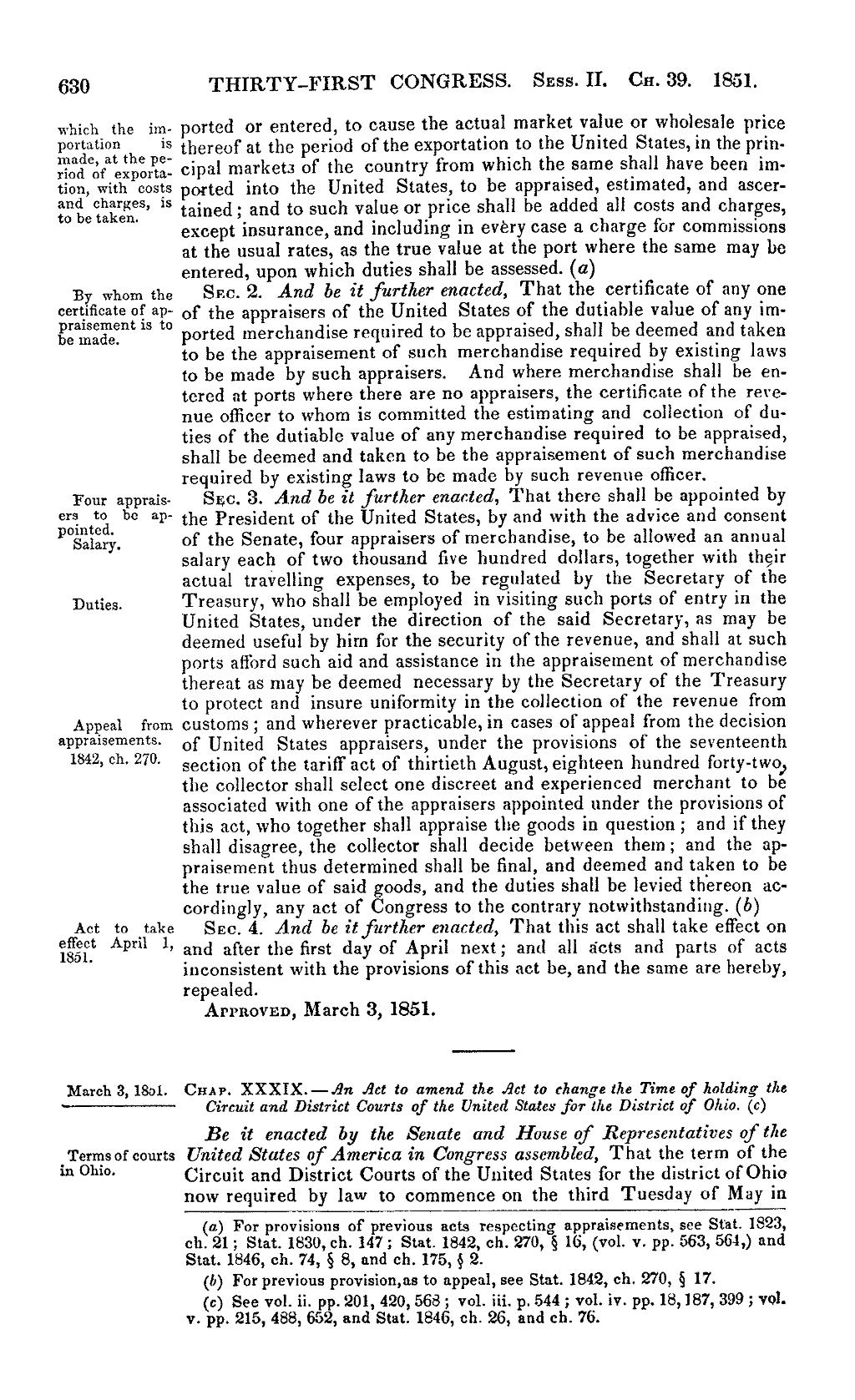

630 THIRTY-FIRST CONGRESS. Sess. I1. Ch. 39. 1851. which the im- ported or entered, to cause the actual market value or wholesale price P°*`*¤°i°¤ h is thereof at the period of the exportation to the United States, in the prin. iisgeggagpzxgi cipal markets of the country from which the same shall have been im. tion, with costs ported into the United States, to be appraised, estimated, and asce;-

- §‘,teQ};;;*ffS’ is tained; and to such value or price shall be added all costs and charges,

except insurance, and including in every case a charge for commissions at the usual rates, as the true value at the port where the same may be entered, upon which duties shall be assessed. (a) By whom the Sec. 2. And be it further enacted, That the certificate of any one ceriificete ct **1* of the appraisers of the United States of the dutiable value of any im- Egxgffnt is t° ported merchandise required to be appraised, shall be deemed and taken to be the appraisement of such merchandise required by existing laws to be made by such appraisers. And where merchandise shall be entered at ports where there are no appraisers, the certificate of the revenue officer to whom is committed the estimating and collection of duties of the dutiable value of any merchandise required to be appraised, shall be deemed and taken to be the appraisement of such merchandise required by existing laws to be made by such revenue officer. Four apprais- Sec. 3. And be it further enacted, That there shall be appointed by °'? *2, be “P‘ the President of the United States, by and with the advice and consent poégigrj of the Senate, four appraisers of merchandise, to be allowed an annual salary each of two thousand five hundred dollars, together with their actual travelling expenses, to be regulated by the Secretary of the Duties. Treasury, who shall be employed in visiting such ports of entry in the United States, under the direction of the said Secretary, as may be deemed useful by him for the security of the revenue, and shall at such ports afford such aid and assistance in the appraisement of merchandise thereat as may be deemed necessary by the Secretary of the Treasury to protect and insure uniformity in the collection of the revenue from Appeal from customs; and wherever practicable, in cases of appeal from the decision "PP““““‘€‘“s· of United States appraisers, under the provisions of the seventeenth 184% °h‘ 270 section of the tariff act of thirtieth August, eighteen hundred forty-two_, the collector shall select one discreet and experienced merchant to be associated with one of the appraisers appointed under the provisions of this act, who together shall appraise the goods in question ; and if they shall disagree, the collector shall decide between them; and the up~ praisement thus determined shall be final, and deemed and taken to be the true value of said goods, and the duties shall be levied thereon accordingly, any act of Congress to the contrary notwithstanding. (b) Act to take Sec. 4. And be it further enacted, That this act shall take effect on iggff APU} lt and after the first day of April next; and all acts and parts of acts inconsistent with the provisions of this act be, and the same are hereby, repealed. Approved, March 3, 1851. March 3, 1801. CHAP. XXX1X.—.8n Act to amend the .6ct to change the Time of holding the ·—··—········ Circuit and District Courts nf the United States for the District of Ohio. (0) Be it enacted by the Senate and House of Representatives of the _Terrns of courts United States of America in Congress assembled, That the term of the ‘“ Ol“°· Circuit and District Courts of the United States for the district ol`Ohio now required by law to commence on the third Tuesday of May in (a) For provisions of previous acts respecting appraisements, see Stat. 1823, ch. 21; Stat. 1830, ch. 147; Stat. 1842, ch. 270, § 16, (vol. v. pp. 563, 564,) and Stat. 1846, ch. 74, § 8, and ch. 175, § 2. (I;) For previous provision,as to appeal, see Stat. 1842, ch. 270, § 17. (c) See vol. ii. pp. 201, 420, 568; vol. iii. p. 544 ; vol. iv. pp. 18,187, 399 ; vol. v. pp. 215, 488, 652, and Stat. 1846, ch. 26, and ch. 76.