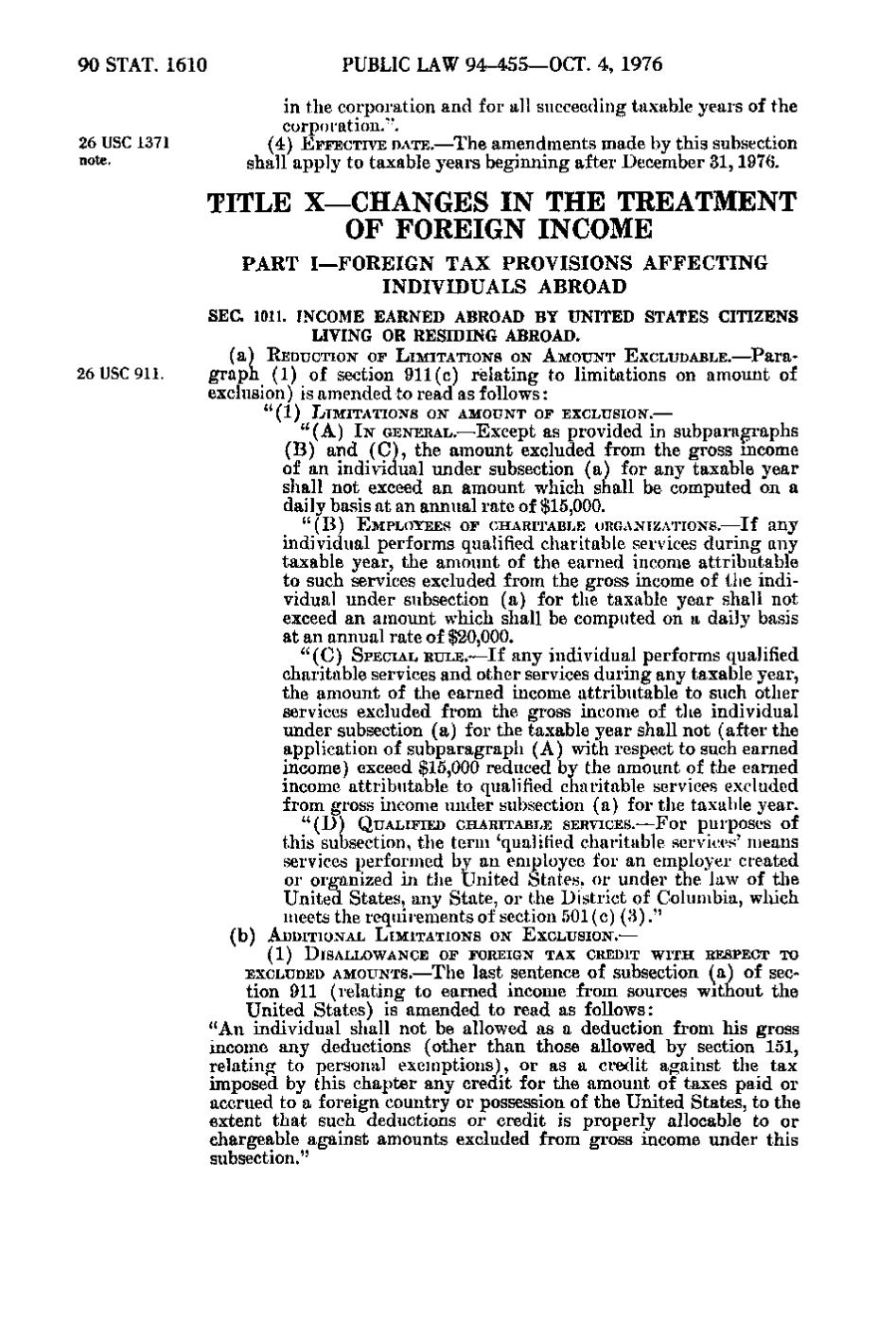

90 STAT. 1610

26 USC 1371 note.

PUBLIC LAW 94-455—OCT. 4, 1976 in the corporation and for all succeeding taxable years of the corporation.". (4) EFFECTIVE DATE.—The amendments made by this subsection shall apply to taxable years beginning after December 31, 1976.

TITLE X—CHANGES IN THE TREATMENT OF FOREIGN INCOME '

PART I—FOREIGN TAX PROVISIONS AFFECTING INDIVIDUALS ABROAD SEC. 1011. INCOME EARNED ABROAD BY UNITED STATES CITIZENS LIVING OR RESIDING ABROAD. (a) REDucTioisr OF LIMITATIONS ON A M O U N T EXCLUDABLE.—Para-

26 USC 911.

g r a p h (1) of section 911(c) relating to limitations on amount of exclusion) is amended to read as follows: " (1) L I M I T A T I O N S ON AMOUNT OF EXCLUSION.—

" (A) IN GENERAL.—Except as provided in subparagraphs (B) and (C), the amount excluded from the gross income of an individual under subsection (a) for any taxable year shall not exceed an amount which shall be computed on a daily basis at an annual rate of $15,000. "(B)

EMPLOYEES o r CHARITABLE ORGANIZATIONS.—If any

individual performs qualified charitable services during any taxable year, the amount of the earned income attributable to such services excluded from the gross income of the individual under subsection (a) for the taxable year shall not exceed an amount which shall be computed on a daily basis at an annual rate of $20,000. " (C) SPECIAL RULE. — I f any i n d i v i d u a l p e r for m s qualified

charitable services and other services during any taxable year, the amount of the earned income attributable to such other services excluded from the gross income of the individual under subsection (a) for the taxable year shall not (after the application of subparagraph (A) with respect to such earned income) exceed $15,000 reduced by the amount of the earned income attributable to qualified charitable services excluded from gross income under subsection (a) for the taxable year. "(D)

QUALIFIED CHARITABLE SERVICES.—For purposes of

this subsection, the term 'qualified charitable services' means services performed by an employee for an employer created or organized in the United States, or under the law of the United States, any State, or the District of Columbia, which meets the requirements of section 501(c)(3). " (b) ADDITIONAL L I M I T A T I O N S ON E X C L U S I O N. — (1) DISALLOWANCE o r FOREIGN TAX CREDIT W I T H RESPECT TO

EXCLUDED AMOUNTS.—The last sentence of subsection (a) of section 911 (relating to earned income from sources without the United States) is amended to read as follows: " A n individual shall not be allowed as a deduction from his gross income any deductions (other than those allowed by section 151, relating to personal exemptions), or as a credit against the tax imposed by this chapter any credit for the amount of taxes paid or accrued to a foreign country or possession of the United States, to the extent that such deductions o r credit is properly allocable to or chargeable against amounts excluded from gross income under this subsection."

�