PUBLIC LAW 97-34—AUG. 13, 1981

95 STAT. 219

subparagraph (C), by striking out the period at the end of subparagraph (D), and by adding at the end thereof the following new subparagraphs: (E) a single purpose agricultural or horticultural structure (as defined in section 48(p)), or "(F) a storage facility used in connection with the distribution of petroleum or any primary product of petroleum." (c) REPEAL OF SECTION 263(e).—Subsection (e) of section 263 is 26 USC 263. hereby repealed. (d) CLERICAL AMENDMENT.—The table of sections for part VI of subchapter B of chapter 1 is amended by inserting after the item relating to section 167 the following new item: "Sec. 168. Accelerated cost recovery system." SEC. 202. ELECTION TO EXPENSE CERTAIN DEPRECIABLE BUSINESS ASSETS.

(a) IN GENERAL.—Section 179 (relating to additional first-year 26 USC 179. depreciation allowance for small business) is amended to read as follows: "SEC. 179. ELECTION TO EXPENSE CERTAIN DEPRECIABLE BUSINESS ASSETS. "(a) TREATMENT AS EXPENSES.—A taxpayer may elect to treat the cost of any section 179 property as an expense which is not chargeable to capital account. Any cost so treated shall be allowed as a deduction for the taxable year in which the section 179 property is placed in service. "(b) DOLLAR LIMITATION.—

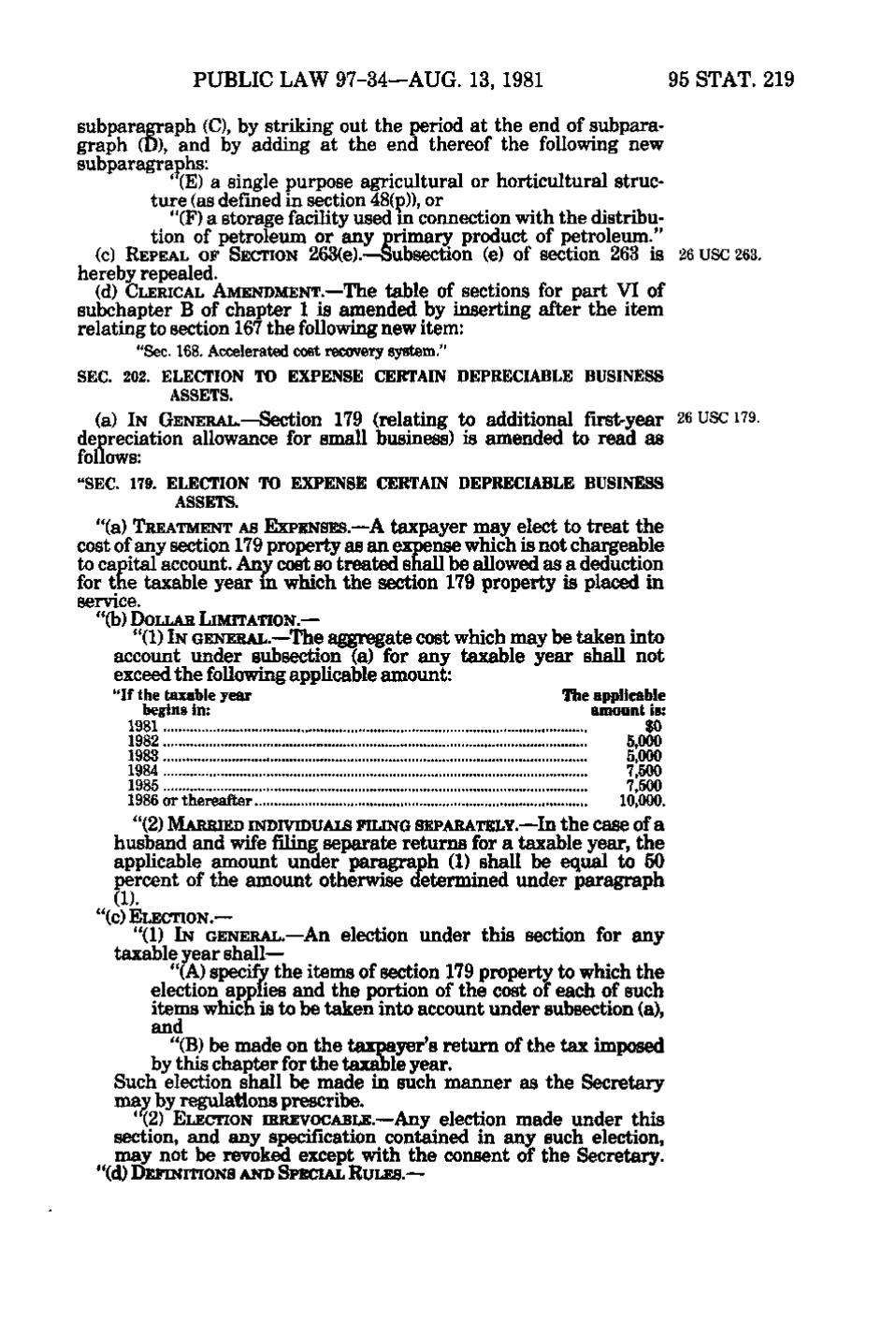

"(1) IN GENERAL.—The aggregate cost which may be taken into account under subsection (a) for any taxable year shall not exceed the following applicable amount: "If the taxable year The applicable begins in: amount is: 1981 $0 1982 5,000 1983 5,000 1984 7,500 1985 7,500 1986 or thereafter 10,000. "(2) MARRIED INDIVIDUALS FIUNG SEPARATELY.—In the case of a

husband and wife filing separate returns for a taxable year, the applicable amount under paragraph (1) shall be equal to 50 percent of the amount otherwise determined under paragraph (1).

"(c) ELECTION.—

"(1) IN GENERAL.—An election under this section for any taxable year shall— "(A) specify the items of section 179 property to which the election applies and the portion of the cost of each of such items which is to be taken into account under subsection (a), and "(B) be made on the taxpayer's return of the tax imposed by this chapter for the taxable year. Such election shall be made in such manner as the Secretary may by regulations prescribe. "(2) ELECTION IRREVOCABLE.—Any election made under this section, and any specification contained in any such election, may not be revoked except with the consent of the Secretary. "(d) DEFINITIONS AND SPECIAL RULES.—

�