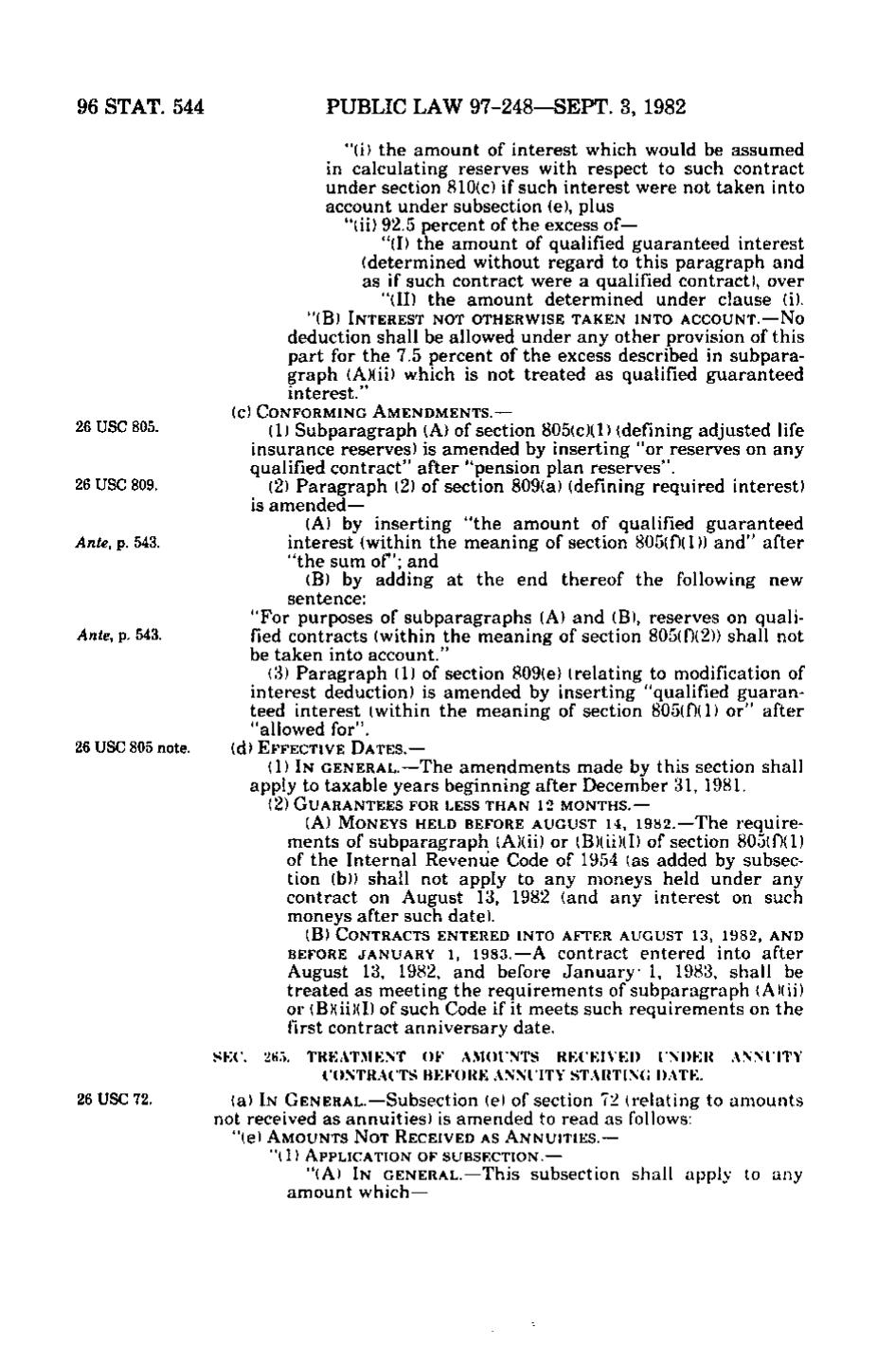

96 STAT. 544

PUBLIC LAW 97-248—SEPT. 3, 1982 "(i) the a m o u n t of interest which would be assumed in calculating reserves with respect to such contract under section 810(c) if such interest were not t a k e n into account under subsection (e), plus "(ii) 92.5 percent of the excess of— "(I) the a m o u n t of qualified g u a r a n t e e d interest (determined without regard to this paragraph and as if such contract were a qualified contract), over "(II) the a m o u n t determined under clause (i). "(B) INTEREST NOT OTHERWISE TAKEN INTO ACCOUNT.—No

deduction shall be allowed under any other provision of this part for the 7.5 percent of the excess described in subparagraph (A)(ii) which is not t r e a t e d as qualified g u a r a n t e e d interest." (c) CONFORMING AMENDMENTS. —

26 USC 805. 26 USC 809. Ante, p. 543.

Ante, p. 543.

26 USC 805 note.

(1) Subparagraph (A) of section 805(c)(1) (defining adjusted life insurance reserves) is amended by inserting "or reserves on any qualified contract" after "pension plan reserves". (2) Paragraph (2) of section 809(a) (defining required interest) is amended— (A) by inserting " the a m o u n t of qualified g u a r a n t e e d interest (within the m e a n i n g of section 805(D(1)) and " after " the sum o f; and (B) by adding at the end thereof the following new sentence: "For purposes of subparagraph s (A) and (B), reserves on qualified contracts (within the m e a n i n g of section 805(f)(2)) shall not be taken into account." (3) Paragraph (1) of section 809(e) (relating to modification of interest deduction) is amended by inserting "qualified g u a r a n teed interest (within the m e a n i n g of section 805(0(1) or" after "allowed for". (d) EFFECTIVE D A T E S. —

(1) IN GENERAL.—The amendments made by this section shall apply to taxable years beginning after December 31, 1981. (2) G U A R A N T E E S FOR LESS THAN 1 2 MONTHS.— (A) MONEYS HELD BEFORE AUGUST 14, 1982. — The require-

ments of subparagraph (A)(ii) or (B)(ii)(l) of section 805(f)(1) of the I n t e r n a l Revenue Code of 1954 (as added by subsection (b)) shall not apply to any moneys held under any contract on August 13, 1982 (and any interest on such moneys after such date). (B) CONTRACTS ENTERED INTO AFTER AUGUST 13, 1982, AND

BEFORE JANUARY 1, 1983.—A Contract entered into after August 13, 1982, and before January 1, 1983, shall be treated as meeting the requirements of subparagraph (A)(ii) or (B)(ii)(I) of such Code if it meets such requirements on the first contract a n n i v e r s a r y date.

26 USC 72.

SKC. 2fi.->. TRKATMKNT OF A.MO I NTS RK( KIVKI) INDKR ANM ITY CONTRACTS BKFORK ANNIITY STARTIN(; I)ATK. (a) IN GENERAL.—Subsection (e) of section 72 (relating to a m o u n t s not received as annuities) is amended to read as follows: "(e) A M O U N T S N O T RECEIVED AS A N N U I T I E S. — "(1) APPLICATION OF SUBSECTION.—

"(A) IN GENERAL.—This subsection shall apply to any a m o u n t which—

�