The Economics of Climate Change: a Primer/Chapter 3

The Economics of Climate Change

The Earth’s atmosphere and climate are part of the stock of natural resources that are available to people to satisfy their needs and wants over time. From an economic point of view, climate policy involves measuring and comparing people’s valuations of climate resources, across alternative uses and at different points in time, and applying the results to choose a best course of action. Effective climate policy would balance the benefits and costs of using the atmosphere and climate and would distribute them among people in an acceptable way.

Common Resources and Property Rights

[edit]Prosperity depends not only on technological advances but also on developing legal, political, and economic institutions—such as private property, markets, contracts, and courts—that encourage people to use resources to create wealth without fighting over or, in the case of renewable resources, significantly degrading them. The effectiveness of those institutions depends in part on characteristics of the resources. Market institutions do not work well when resources have the characteristics of public goods—that is, when it is difficult to prevent people from using the resources without paying for them (consumption is “nonexcludable”) and when the incremental cost of allowing more users is near zero (consumption is “nonrival”). Market failures also arise when the many people using a resource affect each others’ use—for instance, when rush-hour drivers create congestion and air pollution. (In that case, consumption is nonexcludable but rival.) Those characteristics make property rights for public goods difficult to create and enforce. Private industry finds it relatively unprofitable to produce such goods, and consumers have relatively little incentive to maintain them.

The Earth’s oceans and air are particularly hard to carve up into private property, and in the ongoing process of attempting to develop effective institutions to manage them, access to those resources has largely remained open —for the most part, no one owns them, anyone can use them, and no one has to pay. For most of human history, open access to the oceans and air was appropriate because the world’s population was too small and its technologies too limited to deplete stocks of fish, degrade air quality, or affect the climate.

But population growth and advances in technology have changed the way people use natural resources and made them vulnerable to overuse, depletion, and degradation. If resources are free for the taking, people will tend to overuse them; if nobody owns them, nobody will take care of them. That phenomenon is referred to as the tragedy of the commons: everyone wants to use free resources but will degrade them if they do, to the detriment of all.

In the case of climate, people want to use the atmosphere to absorb greenhouse gases so that they may benefit from cheap food and timber and from plentiful fossil energy. In the long run, however, that use may significantly degrade the climate.

An Example: Common Fishing Resources

[edit]To keep from overusing a common resource, people must negotiate and agree on rules about who may use it and how much of which types of uses are acceptable. Fisheries provide a common, straightforward example of the problem: a fishing community may have to determine the sustainable level of fishing for each kind of fish and then limit catches to those levels. Limits on fishing will reduce the market supply of fish and raise their market value. People who are allowed to keep fishing will reap a windfall profit on the fish they can legally catch. (Cheaters, or “free riders,” who catch more than their allowance will also get windfall profits.) In the meantime, anyone whose fishing is restricted is likely to sustain a loss.[1] The community’s challenge is to reach a consensus about who gets to fish and how much; about whether, how, and how much to compensate the losers to win their support; and about how to prevent free riders from catching extra fish and breaking down the agreement. In short, the challenge is to negotiate and enforce a new set of property rights.

The task of developing and enforcing property rights generally falls to governments—and it may be further complicated if several countries are involved and international negotiations are needed to resolve conflicts. Governments use a variety of approaches to regulate fisheries, many of which explicitly involve the technology of fishing. For instance, the government may restrict the size of fish that can be taken, prohibit the use of large dragnets, or require the use of handheld lines. Other regulatory strategies apply more directly to the market for fish. One alternative is to create and distribute a fixed number of fishing permits that limit recipients’ catches (see, for example, Newell, Sanchirico, and Kerr, 2002). Under that approach, fishermen may lose part of their previously unrestricted catch, but their losses are at least partly offset because greater scarcity drives up the price of fish. Consumers lose by paying more per fish for fewer fish. If the government auctions off the limited fishing rights to the highest bidders, fishermen will have to pay to fish; they will thus lose the profits they could have reaped from higher, scarcity-driven fish prices. However, the government will take in revenue that it can use for various purposes, including partially compensating consumers and fishermen.

Whether it distributes or sells them, a government can create private fishing rights (which recipients can buy and sell on open markets) or common property rights (in which a restricted group of people own the fishery together and can exclude everyone else from fishing). A government can also keep or appropriate the common resource as a public property under public management and create a use right—such as a fishing license or a catch limit—that gives recipients temporary or limited access to the resource.

Another alternative for the government is to sell use rights by levying a tax on fishing activity or a “landing fee” on fish catches. Because the tax becomes a cost of catching fish, fishermen will raise the market price of their fish, consumers will buy fewer fish as the price rises, and the government will receive tax revenues. As the demand for fish falls, fishermen will make less money, and some of them will be pushed out of the market. As in the case of auctioned rights, the government will receive revenues that it can use to partially offset consumers’ and fishermen’s losses, and fishing will be maintained at a sustainable level.

A Second Example: Common Air Resources

[edit]As a resource problem, air pollution is typically more complicated than overfishing. Unlike markets for fish, in which a product actually changes hands, people generally do not buy and sell air, so there is no market price that reflects the value of air. In addition, modest air pollution may hurt only some especially sensitive people, or it may contribute to health problems in ways that are hard to trace back to it. Pollution levels may have to be very high before many people notice a problem and demand a remedy. Moreover, there may be many different types of emissions from a variety of sources, so it can be difficult or even impossible to trace particular problems to particular origins.

For example, regional air pollution may come from power plants, factories, buildings, trucks, and cars. Emissions from cars alone can involve millions of drivers, each having a minor effect on the health of millions of people, including each other. No practical way exists for each inhabitant to bargain with each driver over the minor effect that that driver has on him or her.

Nor is it simple to measure the economic trade-offs involved. The benefits from less pollution—improved health, better visibility, and so on—are certainly real but notoriously difficult to evaluate because they are generally not bought and sold in markets. The relative costs of reducing emissions from different sources can also be hard to determine. And the people who enjoy the benefits of lower pollution levels may not be the ones who incur the costs.

Those complexities make it very difficult to determine the costs and benefits of reducing air pollution and to balance or distribute them in a politically acceptable way. Nor is it easy to develop standard property rights for air resources. As a result, people find it extremely challenging to use private markets to resolve conflicts over the use of air resources. The fundamental problem is transaction costs—the costs of motivating and coordinating exchanges; too many parties are involved in too many interactions to negotiate agreement in private markets. High transaction costs force governments to come up with other approaches to managing air pollution.

The Atmosphere and Climate

[edit]The problem of climate change involves very large transaction costs. Emissions come from the land- and energy-using activities of practically everyone in the world, and the potential burden of their effects will be borne throughout the world by generations of people who are not even born. Moreover, many of the potential impacts of climate change—the disruption of ecosystems and extinction of species, for instance—are themselves public in nature.

Those factors make it very hard—if not impossible—to clearly define individual rights and responsibilities for many of the activities that may contribute to climate change and the effects that may come from it. Certain types of rights, such as rights to emit greenhouse gases by burning fossil fuels, could be delineated without great difficulty. Other rights, such as credits for carbon stored in the soil and trees of a forest stand or in the ocean, would be more complicated to define. Still others—such as the right to enjoy a particular type of climate in a particular part of the world at a particular time—would be impossible. Without clearly delineated, enforceable rights, individuals cannot easily bargain with one another in markets to resolve their conflicting claims. And as Chapter 2 discussed, the scientific and economic uncertainty involved makes climate trade-offs extremely difficult to evaluate.

In sum, policymakers may be faced with the extraordinarily complicated task of managing a resource that no one owns, that everyone depends on, and that provides a wide range of very different—and often public—benefits to different people in different regions over very long periods, benefits for which property rights would be very difficult to define, agree on, and enforce. The causes and consequences of climate change are international, and that fact has several ramifications: governments will probably have to cooperate for any management approach to be effective; for some time to come, they will have only very imperfect information on which to base decisions; and their decisions may affect the world for centuries. If governments decided that the risks associated with climate change called for action, they might have to persuade people to make sacrifices today to benefit future generations.

Reaching collective agreement on a policy involving use of the atmosphere and climate change is an immense challenge because everyone has an incentive to “free ride.” A successful agreement need not require equal action by all parties, but an agreement of any kind will break down if some parties sacrifice to meet an overall goal and other parties cheat, increasing their emissions in violation of the goal. Moreover, without a clear sense of whether, when, and by how much emissions should be constrained, nations will find it very hard to agree on the appropriate level of action. Equally important, nations have very different historical and economic circumstances; they vary widely in their ability and willingness to bear the cost of reducing emissions—or the possible costs of climate change. These factors help explain the great difficulty nations are experiencing in trying to reach agreement on a distribution of rights and responsibilities.

Further complicating any collective agreement is the fact that governments generally are not subject to the market forces that drive competitive firms to efficiently provide the goods and services that consumers most want to buy. Instead, governments tend to represent coalitions of private and bureaucratic interests that often engage in rent-seeking behavior—attempting to redirect the economy’s resources to their own advantage. As a result, governments do not necessarily provide the public services most desired by consumers; nor do they provide them at the lowest cost. There is consequently no guarantee that governments will be better than markets at managing common resources.

Economic Trade-Offs

[edit]Economic valuation is inherently about measuring trade-offs—among people and resources and across time. Resources are limited, and people are forced to choose among alternative uses, trading some things that they might like to have for things of higher priority. The economic value of a resource reflects those choices rather than something intrinsic to it. Value is measured by people’s willingness to pay for the benefits that a resource provides—or, nearly equivalent, their willingness to accept compensation for lost benefits.[2]

When markets work well, market prices communicate people’s preferences—their choices among alternative uses of resources and between using resources today (and perhaps damaging or depleting them) and maintaining them in their current state to be used later. For nonrenewable resources such as oil, the trade-off involves balancing the benefits of using them up now against the benefits of preserving them so that they can be used later. For renewable resources such as fisheries, the trade-off involves balancing the benefits of fish consumption today against the benefits of maintaining a breeding stock for tomorrow. In an efficient market, resources are used to provide people with the goods and services that they most want to have, when they most want to have them.

When markets do not work well, prices may not adequately reflect people’s willingness to pay for the benefits that the use of a resource provides. That situation can arise when property rights are poorly delineated or inherently difficult to define, as in the case of public goods. It also can arise when limited information makes it difficult or impossible for individuals to decide what value they place on a resource. For instance, even experts are uncertain about the likelihood of abrupt changes in climate, or how changes in climate might disrupt species and ecosystems, or how those disruptions might affect society. Those factors converge in the case of climate change, which involves great uncertainty about a public good.

In attempting to manage such resources, policymakers may simulate markets by estimating individuals’ willingness to pay, using proxy measures that economists have developed for resources that are not directly bought and sold. Even with those measures, however, policymakers face the challenge of limited information, as well as the impossibility of learning what values future generations might assign to those resources.

Balancing Competing Uses of the Atmosphere

[edit]Effective management of the atmosphere involves balancing the incremental benefits of using it as a sink for greenhouse gas emissions—that is, the additional benefits provided by the last ton of emissions—against the incremental costs (or benefits) of the climate change that may gradually result from that ton of emissions.[3] Similarly, effective management involves balancing the incremental costs of investing in research on climate change against the incremental benefits of the advancements in knowledge that result. That balancing of current costs and future benefits also includes weighing the cost of reducing emissions to avert climate-related problems in the future against the cost of adapting to the climate change that occurs—that is, balancing mitigation and adaptation. If the incremental costs of reducing emissions today are higher than those of adapting to the consequences of emissions in the future—say, by spending more on insect control to prevent the spread of tropical diseases—then it would be more cost-effective to reduce emissions less and to adapt more.

Put another way, effective climate policy involves making investments today to yield future returns in the form of a beneficial climate—with due regard for the scientific and economic uncertainty involved. Those investments could take several forms, such as restrictions on emissions levels and research to improve understanding of the physical processes of climate change and to develop alternatives to fossil fuels.[4]

Climate policy thus involves balancing investments that may yield future climate-related benefits against other, non-climate-related investments—such as education, the development of new technologies, and increases in the stock of physical capital—that are also beneficial. If climate change turned out to be relatively benign, a policy that restricted emissions at very high expense might divert funds from other investments that could have yielded higher returns. Conversely, if climate change proved to be a very serious problem, the same policy could yield a much higher return.

Since resources devoted to climate policy would be diverted from other uses, the total benefit from all types of investment would be greatest if the rates of return were the same “at the margin”—that is, for the last dollar of each type of investment. However, efforts to ensure equal rates of return become extremely complicated in the case of long-term issues such as climate change. Few other investments compare with climate policy in yielding an enormous variety of returns on a global scale and over such long periods, or in having returns that are as uncertain. Furthermore, very long time horizons render the results of cost-benefit analyses extremely sensitive to the rate of return that is assumed for the analysis.

The appropriate course of action—and the appropriate level of climate-related investment—depends on how one balances the competing interests of present and future generations and how one accounts for the existing scientific and economic uncertainty. Those choices, in turn, are expressed in the desired rate of return on that investment—that is, the chosen discount rate (see Box 1). While analysts have reached no consensus on what discount rate should be applied, several of them have argued that it should be lower than the rates assumed in typical cost-benefit analyses, for several reasons:

- Society’s investment opportunities over the long term are uncertain;

- There are no centuries-long financial markets in which to invest risk free or from which to determine very long-term rates of return; and

- People’s attitudes toward the distant future may not be correctly reflected in the assumption of a constant discount rate based on historical market returns.[5]

The challenge is to come up with valuations that reflect what people, taken together, may plausibly be said to consider appropriate and that are also consistent with how people may actually be able to transfer resources across time (by making investments today that yield income in the future).

If lower discount rates are deemed appropriate for evaluating very long-term costs and benefits, they justify taking measures to increase society’s rate of investment not only in preserving a benign climate but in expanding the stock of all types of long-lasting capital. By increasing investment to the point at which the last investments all earn rates of return that are consistent with the lower discount rate, such measures would tend to reduce current generations’ consumption in order to provide more wealth for generations in the future.

Integrated Assessments of Costs and Benefits

[edit]Over the past 15 years, a large number of studies have analyzed the potential costs and benefits of averting climate change. Some researchers have attempted to incorporate the studies’ results in global and regional models of economic growth and climate effects and have used the models to conduct so-called integrated assessments of policy proposals related to climate change. They have also estimated the costs of emissions control policies that would yield the greatest net benefits in terms of economic growth, reduced emissions, and the resulting climate effects.

Those assessments and their findings are best thought of as general illustrations rather than as exact calculations of the cost of optimal policies. Analysts must make many simplifying assumptions for such evaluations; consequently, every study excludes some potentially important dimension—dealing with different gases, technologies, countries, generations, environments, and so forth. Nonetheless, integrated assessments provide a sense of the relative importance of different factors, highlight those of greatest importance, and help policymakers focus on the trade-offs involved.

Integrated assessments of the potential costs and benefits of averting climate change typically find relatively small net benefits from stringent emissions controls in the near term, even though they conclude that the continued growth of emissions could ultimately cause extensive physical and economic damage. In balancing alternative investments, the assessments conclude, modest restrictions on emissions today would yield net benefits in the future, but extensive restrictions would crowd out other types of investment. The loss of that investment would in turn reduce the rate of economic growth and thus damage future generations’ material prosperity even more than the avoided climate change would have.

Integrated assessments generally conclude that the most cost-effective way to respond to the risks of climate change is through a gradual process of adjustment. Several considerations support that conclusion (see Wigley, Richels, and Edmonds, 1996):

- Much of the energy-using capital stock is in the form of very long lived power plants, buildings, and machinery. Gradual adjustment would give people time to use up the existing stock and replace it with more-efficient equipment.

- When viewed from the present, the cost of reducing emissions in the future is cheaper because of discounting.

- Technological change will probably lower the cost of controlling emissions. (In addition, it might take a long time to develop alternative technologies, and there would be more incentive to engage in research and development over the long term if it was fairly certain that the policies in place were gradually going to create a large market for nonfossil energy.)

- People are likely to be wealthier in the future and therefore may find it easier to pay to reduce emissions. If income and wealth grow and technology improves as expected, future generations may find it relatively easy to cope with the impacts of climate change and to gradually impose increasingly strict restraints on emissions to avert further change.

- At least for carbon dioxide, emissions that occur sooner rather than later will have more time to be absorbed from the atmosphere by the oceans. As a result, any given future target for concentrations could be met with somewhat greater total emissions over the next century if the bulk of the emissions occurred early on.

Box 2 on pages 30 and 31 summarizes findings from a particularly well-known integrated assessment model developed by William Nordhaus. The study illustrates how integrated assessment can be used to provide a “best guess” of the climate policy that would yield the greatest net benefits and how sensitive that sort of estimate is to the assumptions built into the assessment. However, the study does not explicitly consider the wide range of uncertainty about scientific and economic aspects of climate change—the topic of the next section.

Coping with Uncertainty

[edit]The extensive scientific and economic uncertainty discussed in Chapter 2 greatly complicates assessment of the costs and benefits of averting climate change. No one wishes to undertake extensive, expensive actions to solve a problem that turns out to be relatively mild—or to take no action to solve a problem that later proves catastrophic. Policymakers are thus forced to hedge their bets and prepare for more than one possible outcome, with the additional complication that whatever outcome occurs is likely to be largely irreversible.[6]

In general, uncertainty about a problem may indicate the need for more, or less, action to address it, depending on the nature of the unknowns (Webster, 2002). The amount of appropriate action also depends on how risk-averse people are—that is, how much they are willing to pay to avoid an uncertain but costly outcome. The greater their degree of risk aversion, the more people will be willing to sacrifice today to reduce the likelihood of adverse changes in climate.

Studies that explicitly account for uncertainty generally recommend greater effort to avert climate change than do analyses that do not account for it—mainly because the studies include the long-term discount rate as an uncertain variable.[7] However, the way those studies treat uncertainty about the discount rate in effect simply applies greater weight to future generations and therefore recommends more action. Because the issue of discounting is mainly a distributional one, many analysts question whether it should be treated as a matter of uncertainty in the same sense that, say, the sensitivity of the climate to carbon dioxide concentrations is uncertain.

Another area of uncertainty—often ignored in economic analyses—involves the actions of governments in the future. Integrated assessments that conclude that only modest actions are called for today assume that policymakers will in fact take more-stringent action in the future, should it prove prudent. However, governments may not be able to commit themselves to increasingly stringent future policies. That problem is part of a broader difficulty in addressing long-term challenges: current generations have few means to constrain the behavior of succeeding generations.

Because of uncertainty and the long time frame involved, climate policy will inevitably involve a sequence of decisions. At each stage, policymakers would determine a near-term plan, based on the information accumulated to that date and composed of both research to further improve knowledge and action to reduce risk. The information uncovered during the succeeding period would set the stage for the following round of decision-making.

Because better information can help policymakers make better choices, there are likely to be benefits to conducting climate-related research and developing technological options to reduce the cost of controlling emissions. One recent analysis estimated that the potential benefits of research to reduce uncertainty about the risks of climate change could total roughly $1 billion to $2 billion per year in 1990 dollars ($1.3 billion to $2.6 billion in 2002 dollars).[8] About half of those benefits of research would come from better information about the value of damages from different amounts of climate change. Another quarter would come from better information about how much it would actually cost to reduce emissions. Relatively little of the total benefit would come from better information about future growth of the global population or particular nations’ economies, or about the functioning of the climate system.

Other studies suggest that research to accelerate the development and deployment of low-emissions technologies might yield net benefits, given the current range of uncertainty about future technological advances (see, for example, Papathanasiou and Anderson, 2001). The benefits would flow from lowering the cost of such technologies and thus making the transition to nonfossil energy less expensive than it would otherwise have been if potential damages from climate change had turned out to be large.

Box 1. Discounting and the Distant Future

[edit]For a variety of reasons, people place less value on the future than they do on the present; a dollar today is worth more to them than a dollar tomorrow. The practice of valuing future income less highly than current income is called discounting. A person who greatly devalues, or discounts, future consumption and hence does not save and invest much is said to have a high discount rate. A person who places great value on the future is said to have a low discount rate.

Such valuations are expressed in the market as interest rates. Market interest rates balance everyone’s current supply of and demand for savings—they represent the market’s summing up of society’s competing preferences for present and future income. Some people save part of their income, thus accumulating wealth; others spend more than their income, making up the difference by borrowing or by running down their savings. Overall, savers outpace dissavers; thus, society as a whole saves a fraction of current income and invests it in activities—such as conducting research, building physical capital, and developing human skills—that will help provide goods and services in the future.[9] Adjusted for taxes and risk, interest rates also represent the marginal rate of return on investment (the rate on the last dollar of investment), or the rate—given the existing stock of resources, capital, technology, and labor—at which savings can be converted into future income.

If people had less of a preference for current consumption (a lower time preference)—and thus lower discount rates—they would save and invest more of their current income. Because highly profitable investment opportunities are not unlimited, people’s pursuit of increasingly less profitable ones would drive down the marginal rate of return. Ultimately, their lower time preference would be reflected in a larger stock of capital, greater output and income, and lower interest rates. Conversely, greater preference for current income would be reflected in lower future income and higher interest rates.

Economists who analyze public policy reason that if a public investment is going to improve public welfare, it should produce rates of return similar to those of the private investments that it displaces. So in analyzing the costs and benefits of policies intended to avert climate change, economists typically apply discount rates that are similar to market interest rates, after adjusting for taxes, risk, and inflation. Those discount rates reflect the distributional choices that people in the economy, taken together, actually make.

However, conventional discounting arouses a great deal of controversy when it is applied to long-term issues because at discount rates that approximate market rates, even very large long-term costs and benefits are dramatically devalued (see the figure).[10] The choice of discount rate therefore makes a huge difference in thinking about long-term problems such as climate change.

Long-term discounting has such a strong effect precisely because private investments yield relatively high rates of return. As long as society continues to have extensive opportunities for investment, it will be able to set aside modest resources today, continuously reinvest the earnings, and have enormous wealth in the distant future. If income continues to grow at 20th-century rates, future generations will have much greater resources than current generations have to offset a climate-related loss of well-being.

Box 2. An Example of Integrated Assessment

[edit]A recent study by William Nordhaus, reported in 2000, illustrates how integrated assessment can be used to analyze the trade-offs involved in climate policy.[11] Drawing on an extensive review of the literature, the study concluded that modest warming of up to 2.3º Fahrenheit (1.3º Celsius) would have essentially no net impact on the world economy and might even yield some net benefits. But the study also concluded that in the absence of efforts to reduce emissions, the average global temperature would rise by about 3.6ºF (2.0ºC) over the next century and by 6.1ºF (3.4ºC) over the next two centuries. Those changes would inflict damages—measured as a reduction in world economic output—of roughly 1.0 percent (about $1 trillion in 2000 dollars) in 2100 and about 3.4 percent (nearly $7 trillion) in 2200. Such damages would include losses of agricultural land, forests, fisheries, and freshwater resources; gradual inundation of coastal areas as sea level rose; adverse effects on people’s health; and, to some extent, possibly catastrophic surprises.

Yet the study concluded as well that those significant damages would have only a relatively minor economic impact because the world economy was likely to grow very rapidly over the period. Under the study’s “best guess” assumptions, costs and benefits would be best balanced by imposing a charge today on greenhouse gas emissions throughout the world of roughly $10 per metric ton of carbon (mtc) and gradually raising that charge at a pace related to the rate of global economic growth.[12] (More-rapid economic growth would lead to higher levels of emissions and therefore require an emissions charge that also grew more rapidly.) By 2100, the study’s recommended policy would have reduced global emissions by only about 10 percent. The cumulative reduction in emissions over the century would have little effect on average global warming, reducing it from about 4.4ºF to 4.2ºF (2.5ºC to 2.4ºC).

The study found little net advantage in averting climate change because the assessment balanced current prosperity against future prosperity and the future benefits of economic growth against the future benefits of a stable climate. To avert climate change over the long run, society would have to reduce emissions both today and later. That policy would reduce current generations’ prosperity and slow the rate of economic growth, thus leaving future generations less affluent, too. Given the contribution of fossil fuel use to both economic growth and climate change, the study found little benefit in slowing warming.

Sensitivity to Assumptions

[edit]The study’s results were strongly influenced by its estimates of how much warming would occur in the future and of the impacts from such warming. Another important factor was its assumptions about how future generations would value those effects. More-rapid warming from a given quantity of emissions would justify higher charges on emissions, as would a higher level of damages from a given amount of warming. But if those greater damages occurred sufficiently far in the future, they would not justify higher charges on emissions today. For instance, if warming of more than 4.5ºF (2.5ºC) would cause an economic catastrophe, it would be cost-effective to impose very high emissions charges as warming approached 4.5ºF toward the end of the century to force the economy to move away from its reliance on fossil energy sources. Even in that case, however, the most cost-effective approach would still be to impose relatively small charges on emissions today and then raise them rapidly in the future.[13]

Like the results of all such assessments, the Nordhaus study’s findings were also strongly tied to its assumptions about the sources of future growth and its weighing of the welfare of current generations against that of future generations.[14]

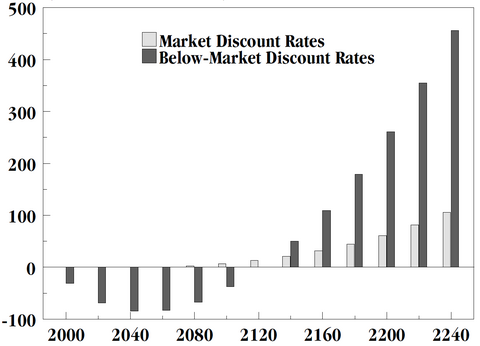

Projected Benefits of Climate Mitigation Under Different Discount Rates

Source: Congressional Budget Office, using the DICE99 model.

Applying a lower discount rate gives more weight to the well-being of future generations, shifting the balance of costs and benefits in favor of investing more to reduce emissions today (and investing more in other kinds of capital formation as well). An extreme case would be to apply a discount rate that took into account only the expected gradual increase in future generations’ well-being that sprang from economic growth. Such a rate would still discount events a century from now by about two-thirds, but it would justify much higher current charges on emissions—on the order of $160 per mtc—to balance current and future costs and benefits. That stringent a policy would slightly reduce the consumption of people alive over the coming century but greatly increase the consumption of succeeding generations (see the figure).[15] Conversely, a higher discount rate would give more weight to the present and shift the balance of costs and benefits in favor of less investment and more consumption today.

The study’s recommended policy is much less sensitive to estimates of costs for abating emissions than to the choice of discount rate.[16]

If abatement turned out to be considerably cheaper (or considerably more expensive) than the study’s “best guess,” the recommended charge would still be roughly $10 per mtc, but it would induce greater (or fewer) reductions in emissions.[17]

Evaluating the Integrated Assessment Method

[edit]The Nordhaus study illustrates both the usefulness and the limitations of integrated assessment. On the plus side, the study assesses different aspects of the climate problem in a consistent, relatively simple framework. It also provides a point estimate based on best guesses about global economic growth, energy use, and emissions; the climate’s response to rising greenhouse gas concentrations; the economic value of the resulting impacts; and the discount rate. The model’s simplicity helps analysts understand how changes in those assumptions affect estimates of costs and benefits.

On the minus side, the assessment includes only energy-related carbon dioxide emissions. Moreover, it ignores distributional issues within generations, in part because it combines all impacts into a single estimate—which offers little insight into the extent to which positive and negative effects might offset each other or might be experienced by different groups of people. (Nordhaus, 2000, addresses some international distributional issues in an extension of the model discussed here.) The model is also based on crude guesses about the value of changes in unmanaged ecosystems, for which there are no market measures. Perhaps most important, it does not explicitly consider the wide range of uncertainty that exists on many dimensions—which, if incorporated into an assessment, can strongly influence its conclusions.

Distributional Issues

[edit]Crafting climate policy involves not only balancing costs and benefits but also distributing them—within and among countries, regions, and generations. Policies that balance overall costs and benefits do not necessarily balance them for every person, and policies that maximize the net benefits to society do not necessarily provide benefits to each individual. A policy may yield positive net benefits by causing both very large aggregate losses and only slightly larger aggregate gains.[18]

Distributional concerns are at the heart of much of the controversy about climate policy. For example, imposing controls on emissions today would cut coal mining companies’ profits but would benefit manufacturers of solar energy equipment. Preventing climate change in the future might greatly benefit countries at very high risk of damage but might actually hurt countries that stood to gain from a warmer climate. Similarly, emissions control policies would impose costs on people today and yield benefits to people in the future.[19]

Issues Among Generations

[edit]Acting to prevent climate change today would place a burden on people now alive and would probably leave coming generations with a climate more similar to today’s—but with somewhat less wealth—than they would have had otherwise. In contrast, not acting would benefit people today and probably yield somewhat more wealth in the future—but it might also leave the world with a different and possibly worse climate for many generations to come.

Choosing among policies is not purely a matter of balancing costs and benefits but also a question of how to distribute the benefits of energy consumption, land use, and climate among generations. Policy recommendations from the integrated assessments described earlier are very sensitive to such intergenerational choices. (Howarth, 2001, provides an example of an integrated assessment that explicitly considers intergenerational equity.)

Instead of restricting emissions, current generations could address these distributional concerns by making additional capital investments to benefit future generations, with the intention of offsetting potential future damages from climate change or of compensating future generations for those damages. However, because of uncertainty about the kind of damages climate change would cause, it is unclear whether (or how much) more capital would be necessary—or useful—to offset them. Also uncertain is whether intervening generations would pass the additional resources on to subsequent generations or consume the resources themselves.

Concerns Within and Among Countries

[edit]Dealing with the issue of climate change is likely to involve difficult decisions about distributing costs and burdens within countries. Some workers and industries—coal producers, electric utilities, and others—would probably bear a disproportionate share of the burden of restrictions on domestic emissions, as would the regions of a country that produced fossil energy. (The Congressional Budget Office discusses issues of equity in domestic climate policy in its 2000 report on carbon-allowance trading.)

Distributional concerns also dominate discussions of international climate policy and are likely to play at least as important a role in its development as the balancing of costs and benefits will. Policymakers in many developing countries emphasize that developed countries are responsible for the bulk of historical emissions and that many developing countries are apparently more vulnerable to—and less able to cope with—the more damaging effects of climate change. Such leaders tend to argue that developed countries should not only shoulder any near-term burden of reducing emissions but also compensate developing countries for climate-related damages. They also tend to be skeptical of arguments that favor balancing net economic costs and benefits, recognizing that such reasoning may be used to gloss over both distributional issues and disparities in impacts.

In contrast, other policymakers in both developed and developing countries tend to be less concerned about climate-related issues because they believe that their nations are not particularly vulnerable to potential changes in climate or will be able to adapt to whatever changes may occur.

- ↑ Under certain circumstances, limits on fishing may drive up the market price for fish to such an extent that it raises the total value of the catch. In that case, it may be easier to get fishers to agree to restrictions—although limits will raise costs for consumers.

- ↑ People may express their beliefs about intrinsic values in their willingness to pay for environmental benefits. For instance, they may be willing to pay to ensure that a forest they may never see is not cut down or that a species of animal does not become extinct. They are expressing their willingness to sacrifice some other benefits—cheap timber, for example—for the benefit of knowing that the forest or species will be preserved.

- ↑ The atmosphere is a partly renewable resource because the oceans can indefinitely absorb only limited amounts of greenhouse gases. Beyond those limits, the gases begin to build up in the atmosphere and gradually affect the climate. (For carbon dioxide, the limit appears to be roughly a billion metric tons of carbon per year.) In that sense, the atmosphere is a depletable resource.

- ↑ To the extent that they encouraged research or reduced emissions, such investments might also yield benefits in the form of technological side effects, or “spillovers,” or a decline in conventional air pollution. And to the extent that greenhouse gas emissions also contribute to conventional pollution, the costs and benefits of abating such pollution need to be factored in as well.

- ↑ Weitzman (1999, 2001) and Newell and Pizer (2001) discuss that issue further; Cropper, Aydede, and Portney (1994) describe efforts to determine people’s attitudes toward intergenerational equity by measuring long-term discount rates.

- ↑ Climate policy involves a degree of irreversibility in both mitigation and impacts. On the one hand, expensive investments to reduce emissions will be impossible to recoup if warming proves modest or largely beneficial. On the other hand, emitted greenhouse gases are likely to be difficult to withdraw from the atmosphere if warming proves to be very damaging.

- ↑ An analysis of climate-related uncertainty can be found in Nordhaus (1994); two analyses that expand on that work are Pizer (1997) and Newell and Pizer (2001). Because small changes in the discount rate can significantly shift the balance of current and future values, uncertainty about the discount rate dominates those analyses. Under the studies’ assumptions, costs and benefits would be balanced by imposing an international charge on greenhouse gas emissions of roughly $15 to $20 per metric ton of carbon equivalent (in today’s dollars) and raising the charge gradually over time. That estimate is nearly double the estimated charge when uncertainty is not taken into account. Evidence from a wide variety of estimates of mitigation costs suggests that such a charge would reduce global emissions by roughly 4 percent (Lasky, forthcoming).

- ↑ Nordhaus’s and Popp’s analysis (1997, pp. 1-47) measures only the expected benefits of research and not what the required studies would cost.

- ↑ Physical capital is land and the stock of products set aside to support future production and consumption. Human skills—education, training, work experience, and other attributes that enhance the ability of the labor force to produce goods and services—are sometimes referred to as human capital.

- ↑ For instance, imagine a stream of income equal to your current income but beginning in the year 2200 and stretching into the distant future. In one sense, that stream of income is not worth anything to you today because you will not be around to enjoy it. However, you might wish to make an investment today to ensure that your descendants will have that income. If you evaluated that extended stream of income at a discount rate of 2 percent, it would be worth one year of your present income to you today. At 3 percent, it would be worth one month of your current income. At 5 percent, it would be worth half a day’s income, and at 7 percent, it would be worth 10 minutes of income.

- ↑ The estimates provided here, which are in 2000 dollars, come from Nordhaus’s DICE99 model, available as an Excel spreadsheet file at www.econ.yale.edu/~nordhaus/homepage/homepage. htm. The model is a recent update of the original DICE model (described in Nordhaus, 1994), which was one of the seminal integrated assessments of climate change. Both models address emissions only of carbon dioxide rather than of all greenhouse gases, but the results roughly generalize to policies that include all gases.

- ↑ An emissions charge of $10 per mtc would add about $5 to the price of a short ton of coal, about 2.5 cents to the price of a gallon of gasoline, and about 15 cents to the price of a thousand cubic feet of natural gas.

- ↑ Keller and others (2000) come to a similar conclusion in a study that explicitly considers the possibility of a shutdown of thermohaline circulation.

- ↑ The study imposed a discount rate that gradually declined from over 4 percent today to under 3 percent in 100 years. Those rates led the model to assign a present value of about $25 billion—one-fortieth the future value—to a trillion dollars of damages a century from now. The rates had two components. The first and dominant one simply reflected current generations’ preference for income today over income for future generations. The second, relatively minor, component took into account that future generations would be wealthier than current generations, so an additional dollar of income would be worth less to them than to people alive now.

- ↑ Lower discount rates would also justify much higher rates of investment than society currently undertakes, so they would not be consistent with the market’s balancing of the welfare of current and future generations.

- ↑ Compared with the range of cost estimates in the literature, the Nordhaus study assumed that it would be relatively inexpensive to reduce emissions and that technological improvements would make such reductions even easier over time.

- ↑ In the Excel version of DICE99, raising marginal abatement costs tenfold reduces the abatement rate by a factor of eight but raises the currently cost-effective charge on carbon by only 3 percent. Reducing marginal abatement costs by a factor of 10 raises the abatement rate by a factor of six; however, it reduces the cost-effective charge by only about 20 percent.

- ↑ In studying economic problems, economists seek policies that will improve economic efficiency—that will make at least one person better off without making anyone worse off. Such policies are termed Pareto improvements. However, many policy proposals whose net benefits exceed their net costs also have substantial distributional effects. That is, the improvements are worth more than the losses, all told, but some people are made worse off even while others are made better off. Economists refer to such policies as potential Pareto improvements: in principle, the winners could compensate the losers for their losses and still be better off. Such a policy passes a standard cost-benefit test but could still make many people worse off unless it also provided for their compensation.

- ↑ Gradually rising emissions taxes or permit prices would also effectively imply a particular distribution of emissions rights across generations.